working capital funding gap calculation

If however the business chooses to use long term finance this flexibility is lost. For this discussion I define cash flow gap as the difference between the timing of cash inflows and outflows.

Modelling Working Capital Adjustments In Excel Fm

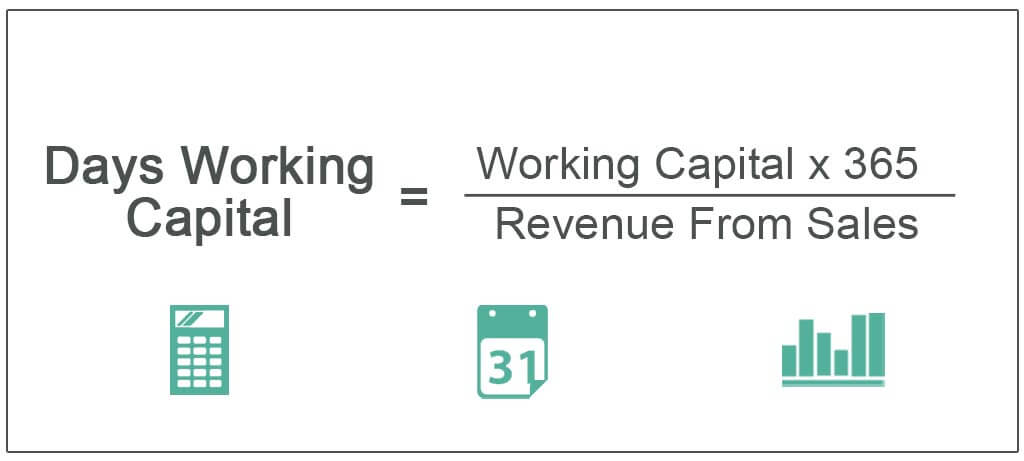

The days working capital is calculated by 200000 or working capital x 365 10000000.

. 456 Days in the period. Current assets minus current liabilities are equal to the Working capital gap. Days working capital 73.

Here the working capital calculation considers. The business must now ensure it has the maximum facility 45000 at all times to fund its working capital financing requirements. It can be shown as.

Compare 2021s Top Online Working Capital Lenders. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if current asset is 100 and current liabilities is 80bank liability is 20. See why working capital management is no longer only a treasury function.

Working Capital Current Assets Current Liabilities. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a. 345 Payable days.

Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. Working Capital Days Receivable Days Inventory Days Payable Days This ratio measures how efficiently a company is able to convert its working capital into revenue. Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

Whats the companys working capital funding gap in days based on the information below. It can also be described as Long term sources few long term uses. Then current liability other than bank borrowings is 80-2060.

365 413 361 583 329 Based on the information below how much does the company need to finance the working capita funding gap and how much is the lender willing to provide. Working Capital Current Assets Current Liabilities. The so called Working Capital ratio current ratio is calculated as.

Go to the LendingTree Official Site Get Offers. Here the working capital calculation considers all sorts of current assets including savings accounts stocks bonds mutual funds cash equivalents inventory items and other short-term prepaid expenses. We need to calculate Working Capital using Formula ie.

Compare up to 5 Loans Without a Hard Credit Pull. 90 days 90 20k invested x 90 18k 38k paid back. Go to the LendingTree Official Site Get Offers.

Get the financing and support you need to reach your business goals. 𝐴. 𝑟𝑓 𝑃1𝑇 In addition companies must also provide all the parameters in the formula above E equity D debt 𝑟𝑓.

472 Inventory days. Calculation of Days Working Capital. Net working Capital Current Assets Current Liabilities.

Cash Flow Gap Management Can Be The Key To Growth And Stability. Equation for calculate funding gap is Funding Gap Adequacy Goal - Current Spending. Your current ratio will give you an idea if you have enough working capital to sustain your business and meet your short-term financial obligations.

Working Capital Gap. The companys working capital would equal 200000 or 500000 - 300000. A working capital formula determines the financial health of the business and it suggests how the profitability can be increased in the future through the current ratio which we get by dividing current assets by current liabilities.

The following steps should be applied to calculate the working capital of the business. 35 Funding gap days Revenues Days in period Cost of goods sold 365 1600000 2500000 Balance Receivables. A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently provided by cash equity or debt.

However if the company made 12 million in. For instance if your supplier terms are 30 days and your customer terms are 60 days you will have a cash flow gap to fill with some form of working capital financing. Ad Working capital supply chain finance advice from leading industry experts.

Whats the companys working capital funding gap in days based on the information below. Net working Capital Current Assets Current Liabilities. In plain terms the working capital deficit is the difference between total liquid assets and total equity other than bank liabilities.

The so called Working Capital ratio current ratio is calculated as current assets divided by current liabilities. The justification consists in demonstrating that the internal company WACC results from the following formula. Ad Get Working Capital Funding Fast.

Ad Turn your outstanding invoices and accounts receivable into working capital. To calculate the working capital needs one needs to use the following formula. The higher the number of days the longer it takes for that company to convert to revenue.

Working Capital Current Assets Current Liabilities. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. The working capital gap is.

Change In Working Capital Video Tutorial W Excel Download

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Working Capital What Is Working Capital Youtube

Working Capital Requirement Wcr Agicap

Working Capital Formula Youtube

Types Of Working Capital Gross Net Temporary Permanent Efm

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Cycle What Is It With Calculation

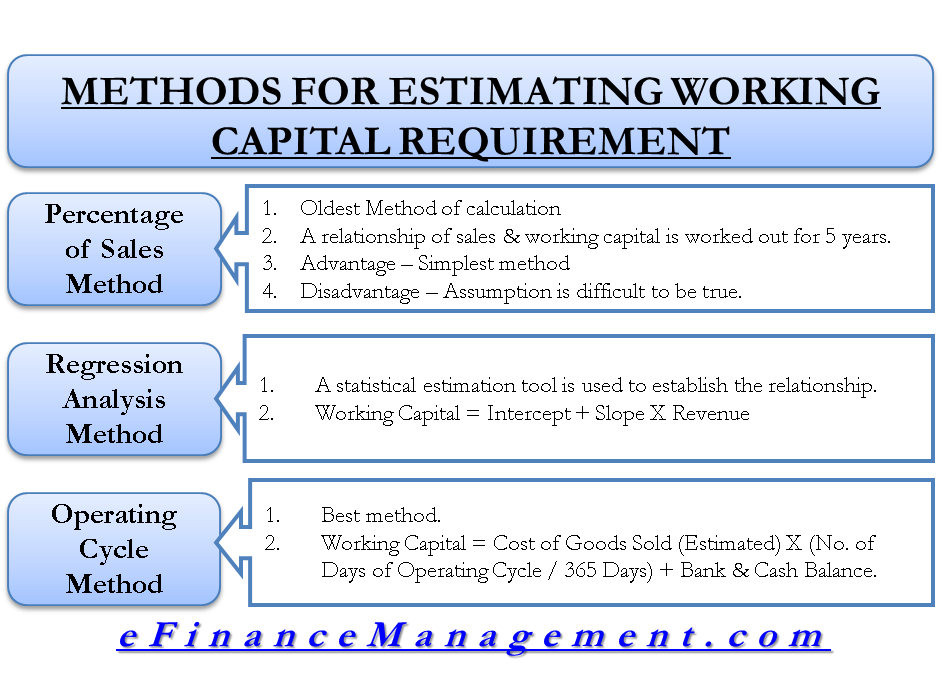

Methods For Estimating Working Capital Requirement

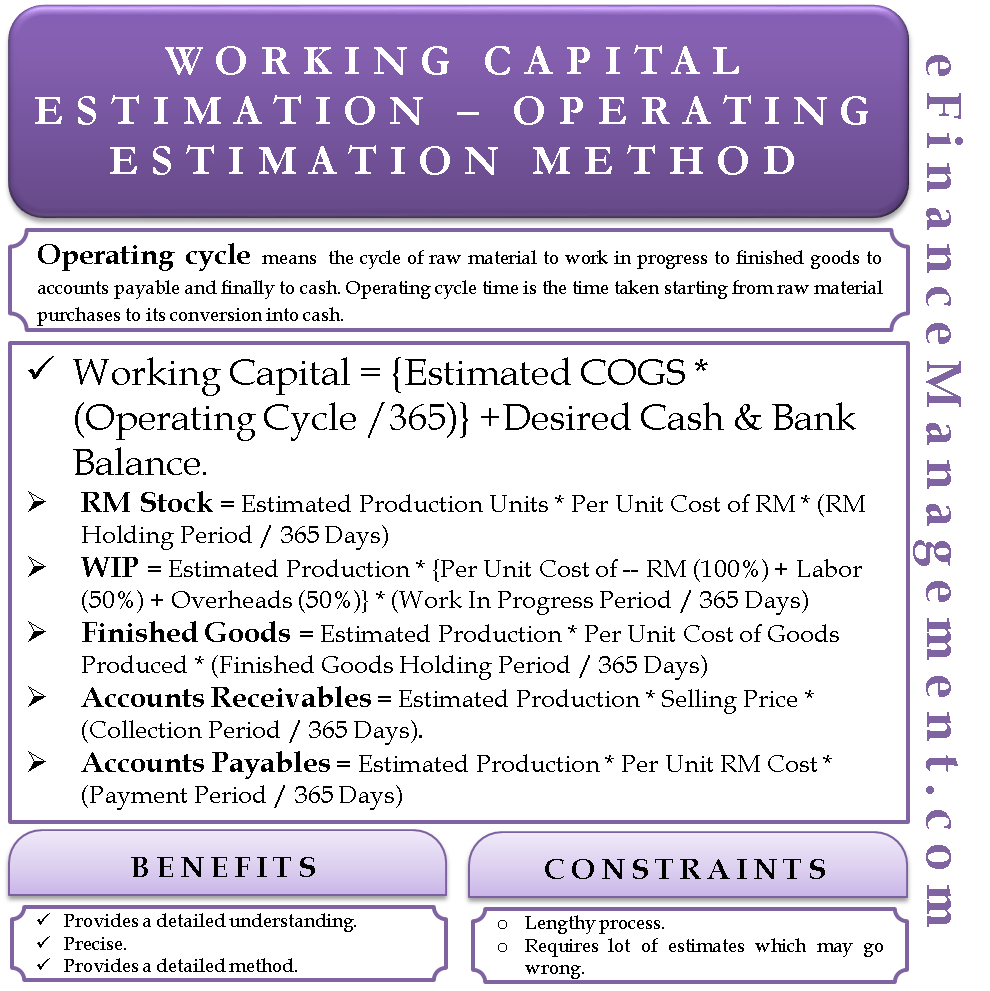

Operating Capital Money Management Advice Financial Life Hacks Accounting Education

Working Capital Cycle Efinancemanagement

Working Capital Estimation Operating Cycle Method

Working Capital Financial Edge Training

Method For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Net Working Capital Template Download Free Excel Template

Days Working Capital Definition Formula How To Calculate

Working Capital Cycle Understanding The Working Capital Cycle

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)